Deeper Dive: A Closer Look at Fixed Participating and Variable Participating Loans

By Paul Harrington, Senior Market Analyst

Over the past few articles, we have covered the Fixed strategies that exist in the UL marketspace. In this post we will cover the popular and innovative space of Participating Loans, both Variable and Fixed. We will cover how they work, the components of each, and who is utilizing what.

Concept of Participating

The term Participating originally came from Whole Life policies where the cash value in the policy was “participating” in the profits of the insurance company through the issuance of dividends. This word has been adapted for Indexed and Variable UL loans where the collateral of the loan is “participating” in the indexed and fixed returns of the policy.

There are multiple ways that products “participate”. The first, and primary way is via a “Pass-Through” where the loan collateral is credited the same as the products indexed and fixed accounts. The second is a more recent trend growing in popularity – using a Stand-Alone account method where the loan collateral account is its own indexed account with its own parameters, separate from the other indexed strategies offered.

We’ll start with the Pass-Through method. As an example, American National utilizes this method on their IULs.

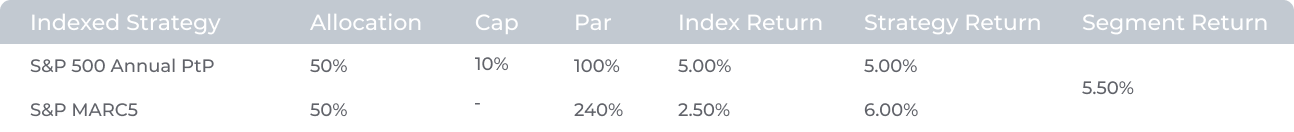

Below is an example of how indexed crediting would be calculated, utilizing the Pass-Through method, the loan collateral account would also be credited 5.50% 1 because the crediting rate passes through to the loan collateral and would receive the 5.50% return.

This method is fairly straightforward. For the purposes of explanation, we assume that there is a loan collateral account, but it should be noted that not everyone uses a loan collateral account. For example, Transamerica states that “The portion of the Policy Value borrowed is secured by identifying part of your Account Value as a “Loaned Value.” However, it is the same principles being applied.

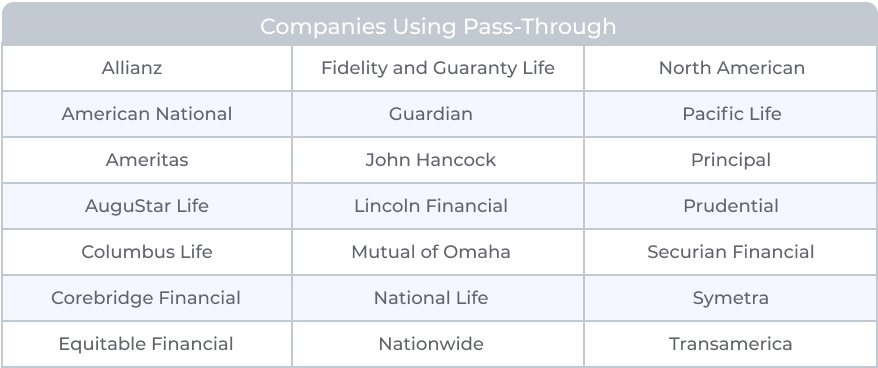

This is the most common method amongst carriers benchmarked on LifeTrends. A list of these companies is below.

The second method is via an independent, or Stand-Alone, loan account. Lincoln Financial uses this methodology and recently expanded it to offer multiple options that only apply to loan collateral. Their recent launch included 4 new indexed loan options that match existing indexed strategies. This is apart from the Fidelity AIM Dividend Indexed Loan Account, which has a 15% lower participation rate than the indexed strategy on the base product.

Pacific Life also recently came out with a new Stand-Alone account that utilizes its low volatility index, the Blackrock Endura and similarly, the participation rate on the stand-alone loan account is less than the indexed strategy. In the same vein, John Hancock offers a lower Cap for the S&P 500 than they do on the indexed strategy.

Charges

There are two different types of charges that can be applied to Participating Loans; Fixed and Variable. As we defined in our first post, Variable is a rate that is tied to an external rate that the company does not control – such as the Moody’s AAA Corporate Bond. Fixed is a rate that is set by the company itself, and within that there is Fixed Declared and Fixed Guaranteed. Fixed Declared means it’s a rate set by the company but it can change at their discretion. Fixed Guaranteed where the rate is guaranteed for the life of the policy, and cannot change. While the rate could be adjusted, it would only apply to new policy issues.

Variable

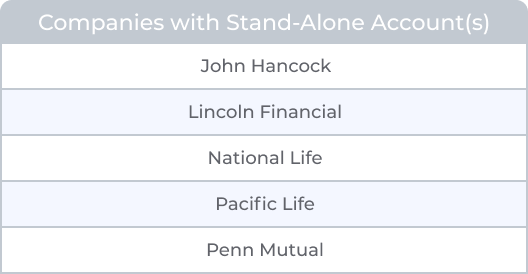

Below are the companies that offer a Variable Participating loan and there are slight differences between a few of them. For some, the rate is tied to Moody’s AAA Corporate Bond (Moody’s) yield but has certain thresholds that have to be met for the rate to move. It’s not a free-floating rate tied directly to Moody’s. For example, National Life’s FlexLife Variable Participating Loan only updates the loan rate based off the Moody’s two months before the policy anniversary. It is not freely changing through the year as the Moody’s rate does.

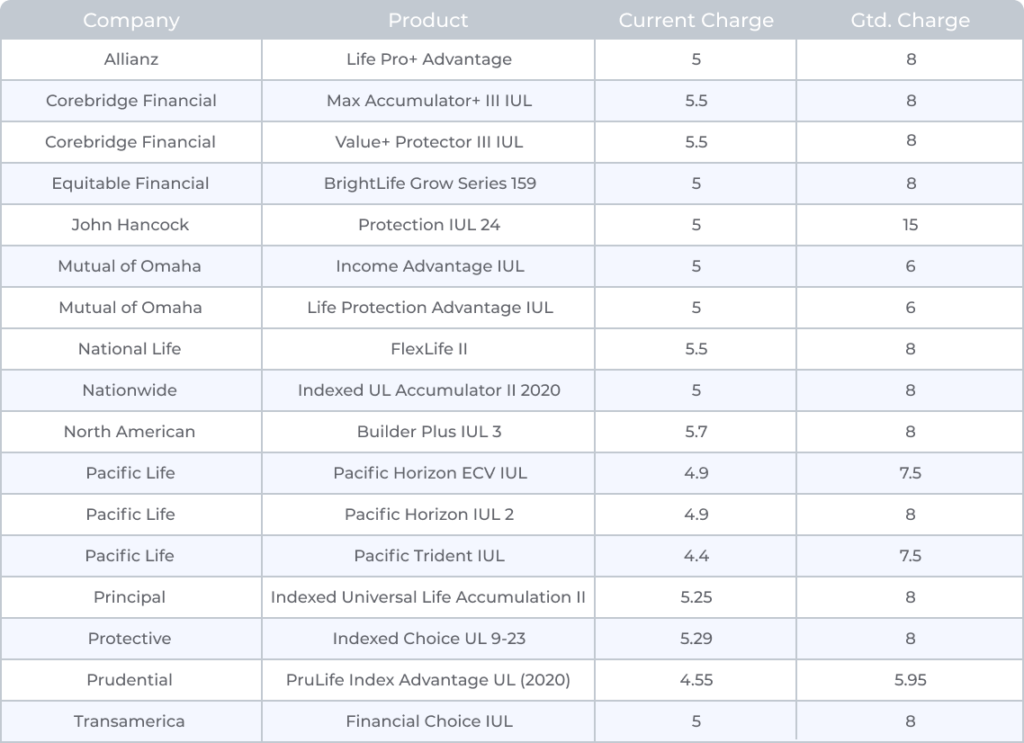

In an increasing interest rate environment, a common question is “well, how high can these rates go?” and that’s a fair question and an area of interest. To answer, this the Max Guaranteed charges are listed. Rates as of 5/20/2024.

Moody’s AAA Corporate Bond Yield

With as much mention of the Moody’s AAA Corporate Bond Yield it’s worth talking about what it is and why it’s used.

What?

The Moody’s AAA Corporate Bond Yield is the average yield of Corporate Bonds that are rated AAA by the Moody’s Rating Agency. Corporate Bonds are debt issued by companies for various durations and serve as a means to raise capital. AAA is the highest possible rating and is supposed2 to reflect the lowest risk of default, which typically means lower yield. A key component of the rating given to the bonds is stability. That in mind, we can see below that compared to the S&P500, the Moody’s yield is vastly more stable. If you want to make something Variable, it needs a level of stability.

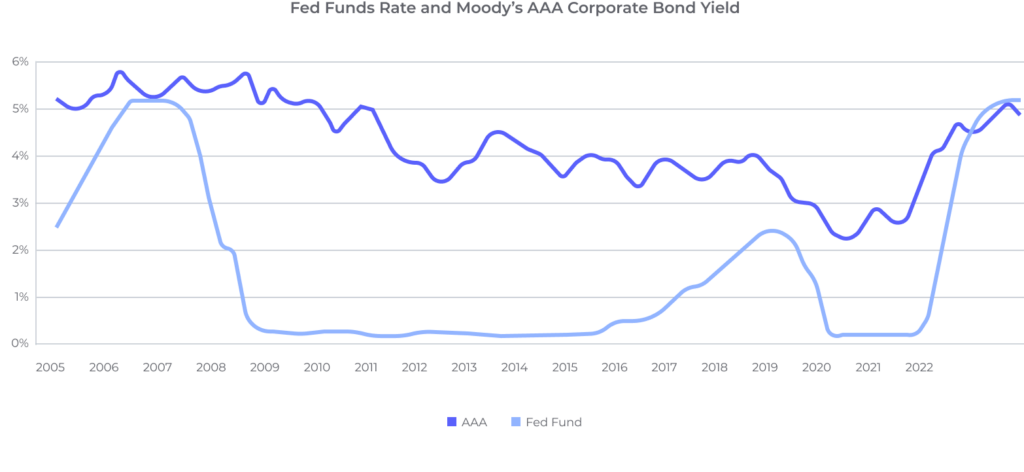

While a slight departure from this topic, given the public discussion about the actions of the Fed and current interest rates, the following graph compares the Moody’s and Fed Fund rates. You’ll notice the Fed Funds rate is higher starting in 2023. This is the first time since 1989 that the Fed Funds rate has been higher than Moody’s AAA. What does that mean? I don’t know but isn’t it interesting?

Why?

Regulation. NAIC Model Policy Loan Interest Rate Bill (590) explicitly includes the Moody’s Corporate Bond Yield Average as the “published average” for variable loan rates. That Model Bill was from 2000. The Interstate Compact standard for Flexible Premium Adjustable Life (I.e. UL) also references this Model Bill in its Loans section.

We will cover how the Participating element interacts with a variable charge structure later when we compare against Fixed Participating loans.

Fixed Declared and Fixed Guaranteed

The other charge type we will discuss is Fixed. We define Fixed as a rate that is set by the company and changes infrequently. Within our Crediting section, we only use the term Fixed, but there are two distinct groups inside the Fixed category. Fixed Declared and Fixed Guaranteed.

Fixed Declared is a rate that is set by company and has the ability to change during the life of the policy. Fixed Guaranteed is a rate set by the company that is guaranteed for the life of the policy. When determining Fixed Guaranteed rates, we include products with an explicit guaranteed statement and those that have their charge rate equal to the guarantee.

Fixed Declared

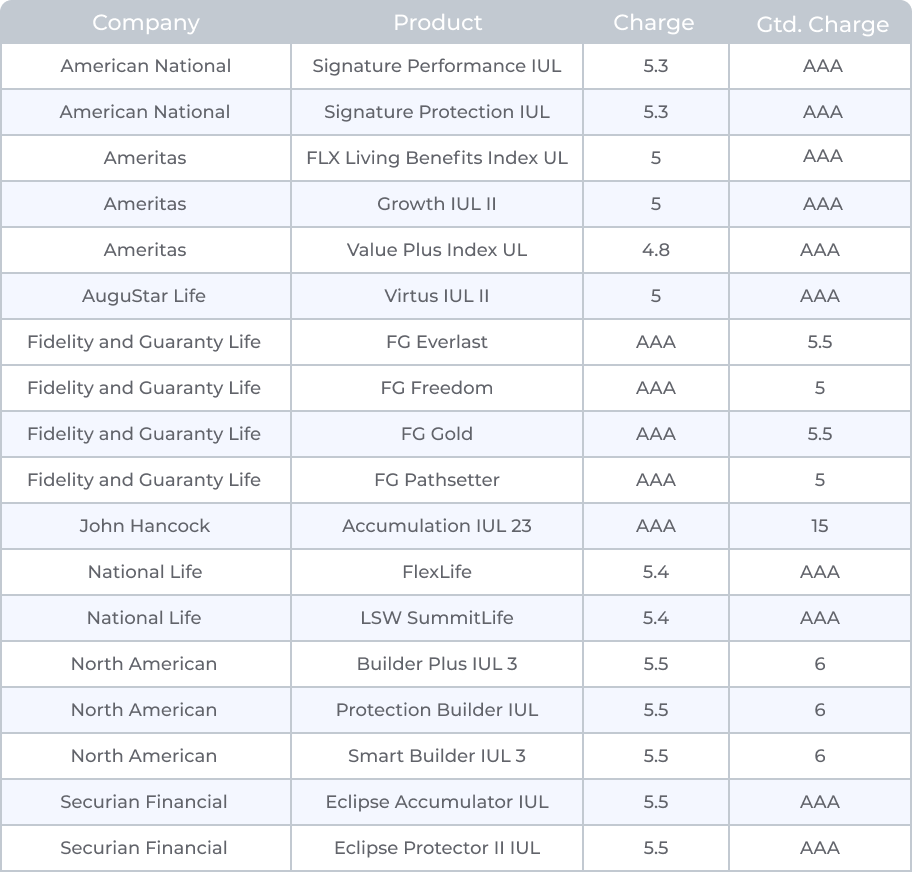

As previously stated, Fixed Declared means it is a rate set by the company that has the ability to change over time. For this purpose, it’s important to understand how high a fixed rate could go. The average guaranteed maximum for Fixed Declared loans is 8%. Below are the companies and products current and guaranteed Fixed Declared charge rates. Rates as of 5/21/2024.

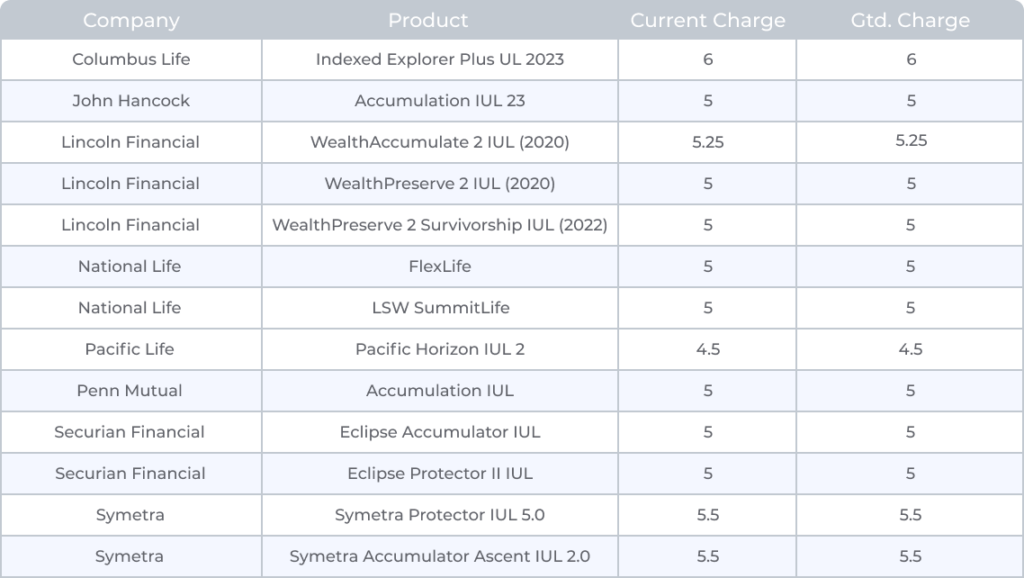

Fixed Guaranteed

Fixed Guaranteed is the rarer of the two loans and we consider to be the focus of the newest trend in this space. In fact, every single Fixed Participating loan that uses a Stand-Alone indexed account as described earlier is utilizing a Fixed Guaranteed loan. Below are all the companies and products that have a Fixed Guaranteed charge rate. Rates as of 5/21/2024.

Additional Things to Consider

The new Crediting section on the platform makes quick analysis of all the different aspects of loan possible, therefore we are not including all this information here. That said, it’s worth considering that Loan availability is also dependent on the Policy Year. For example, the Fixed Participating loan with Transamerica is only available starting in Year 4. In addition, there are restrictions on how many loan types can be used at once. Some carriers only allow for outstanding policy debt to be in 1 type of loan. If someone wants to switch loan types, they have to pay off the existing loan balance first.

Arbitrage

In our 2nd article of the series, we introduced the idea of Arbitrage. As a refresher, this is when there is a difference between the charge rate and the crediting rate on loans. If the charge rate is higher than the crediting rate, the client has a net cost from the arbitrage and if the crediting rate is higher than the charged rate, the client sees a net positive return on their loan.

Arbitrage is the key element of Participating Loans that make them appealing. Let’s examine arbitrage in action and what outcomes are possible with Fixed Participating and Variable Participating loans and their independent charge and crediting methodologies. For all the following examples, we assume the same Day 1 scenario of a loan being taken against $100,000 of Cash Value. Each subsequent example will be what each loan would look like 1 year after Day 1.

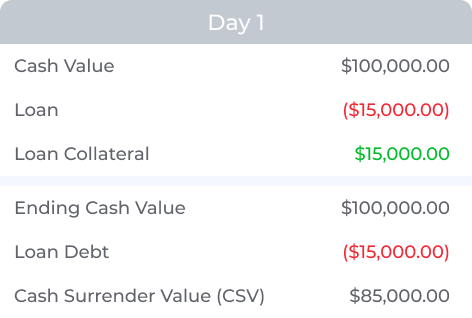

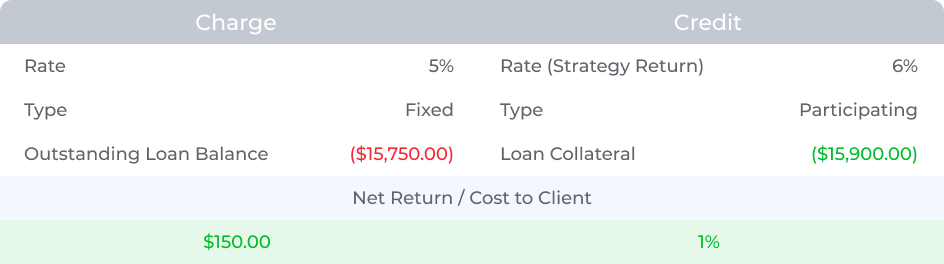

In Figure 5 we have the simplest illustration – how a Fixed Participating Loan can generate a net positive return. On Day 1, when the loan is taken, the Outstanding Loan Balance and the Loan Collateral become $15,000. These offset which keeps the Cash Value at $100,000 but the loan MUST BE PAID BACK by loan repayment or death, and so the Cash Surrender Value reflects this obligation.

At the end of year one, the Fixed charge of 5% is added to the Outstanding Loan Balance while 6% is added to the Loan Collateral as we assume a 6% return from whatever hypothetical indexed strategy you want. This positive difference is the Arbitrage. If the client paid back the loan balance of $15,750 using Cash Value, they will have $150 or 1% more than they started with before taking the loan. Pretty cool, right?

Figure 5 resulted in a positive for the client, but Participating loans are utilizing an external index with varying returns.

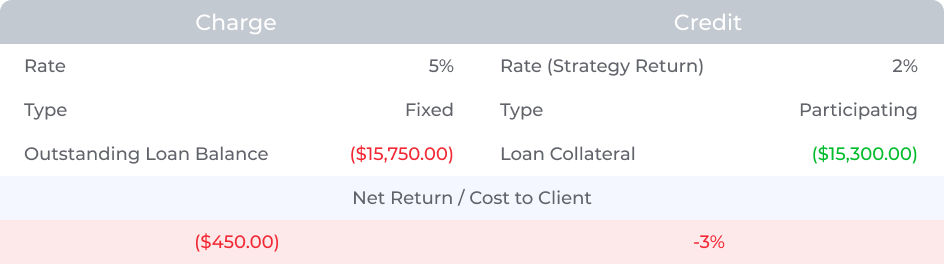

Figure 6 provides a situation where the indexed return is less than the 5% Fixed Charge rate and the client is losing on the arbitrage. But is it that bad of a loss?

While the loan charge is 5%, the client only effectively paid 3%. This is another beauty of Participating Loans, even if you don’t end up with a Net Positive return, there is much more probability to pay less than the stated charge rate, which only happen in years of negative index return. Simply put, any year that the indexed strategy credit is positive is a win for the client as they will be paying less than the stated charge rate.

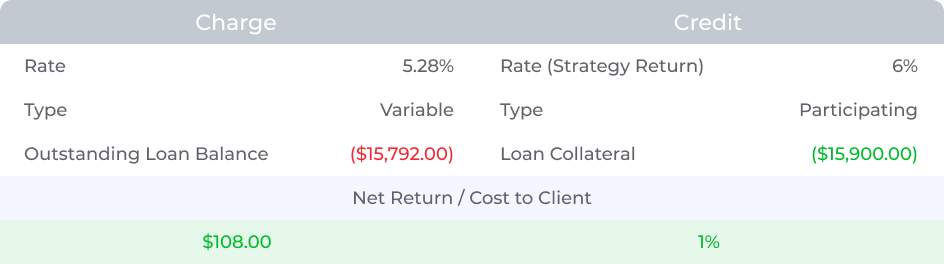

Variable Participating loans work the same in any particular moment in time but due to having the charge rate Variable overtime, there is more volatility associated with them. Figure 7 is a Variable Loan and you’ll notice it is operating the same as the Fixed Participating. The charge rate used is the AAA Bond Yield as of 5/1/24.

Trade-Offs

Just like everything in life, the different options require an understanding of the trade-offs between using Fixed Participating and Variable Participating. Currently, the average Fixed Participating loan charge is 5% and the current average Variable Participating loan charge is also about 5%. So what do you take?

A significant thing to consider that has not been addressed yet is time. The previous examples are assuming one loan at a single period in time. In reality, time is always marching forward and the loan balances, if not paid off, will continue to grow. This is where Fixed and Variable really battle their differences. On the Fixed side, it might be comforting to know, that for your entire life, the rate will never be worse than 5%. Variable, however, could be anything up to the Max rate stated.

Using historical data can give us some perspective, but if the last 4 years have shown us anything, the future is anything but predictable.

When looking back to the beginning of 2010, and going by Quarter, the AAA Bond Yield has been greater than 5% 5 times, or 8.77% of the time. That number rises to 14 times, or 24.56% of the time when looking at 4.5%. In this time frame, the Variable Participating loan would be the more advantageous option compared to a 5% Fixed Rate.

However, we must consider the realities of the world that we live in; increasing interest rates. The AAA bond yield in period between 1980 and 2003 did not see a single year below 6%, in fact peaking at 15.01%. Anyone during this time period would be grateful that they have a Fixed Rate of 5%.

This distinction is also important to consider for Fixed Declared vs. Fixed Guaranteed. While Fixed Declared loan rates don’t change often, they can and do move and could go up to their Maximum (8% being the most common).

Conclusion

Participating Loans within life insurance are quite unique. They offer the capability to have a net return to the client when a loan is taken. How often do you see that? However, clients do have to make risk informed decisions on what type of charge they want; Fixed or Variable.

In the next post, we will be discussing how these loans work in the regulatory environment of illustrations and what designs are being used to navigate that environment.

1 Technically, it would be 5.75% for the indexed strategy due to the .25% Interest Bonus Rider that does NOT apply to loan collateral.

Note from the author:

Special thanks to Joe Kenny at Mutual of Omaha for informational assistance on this piece.