Deeper Dive: A Closer Look at Fixed and Variable Fixed Loans

By Paul Harrington, Senior Market Analyst

In the first Points article of our Deep Dive: Navigating the World of Policy Loans series, we introduced the Loan Quadrants – a chart that helps explain different loan types by considering the Loan Charge and Crediting methods – to serve as a guide for categorizing Policy Loans on the Universal Life chassis. This Deeper Dive article will focus on Fixed and Variable Fixed Loans.

Fixed Loans are the “OG” of loans – the “original loan” that is the most common type and essentially offered on every single UL policy, even if they aren’t designed for accumulation. It should be pointed out that if using the Loan Quadrant definitions, these would be categorized as a Fixed-Fixed loan as the CREDITING is Fixed and the CHARGE is Fixed. However, industry wide they are commonly referred to simply as “Fixed Loans”. The term Fixed is used loosely in this context.

Fixed Loans

LifeTrends defines Fixed as any rate set by the company and is not tied to an external index.

Even this is broad, so let’s drill down a bit further into the 2 different types of Fixed Loans:

- Fixed Guaranteed

- Fixed Declared

Fixed Guaranteed

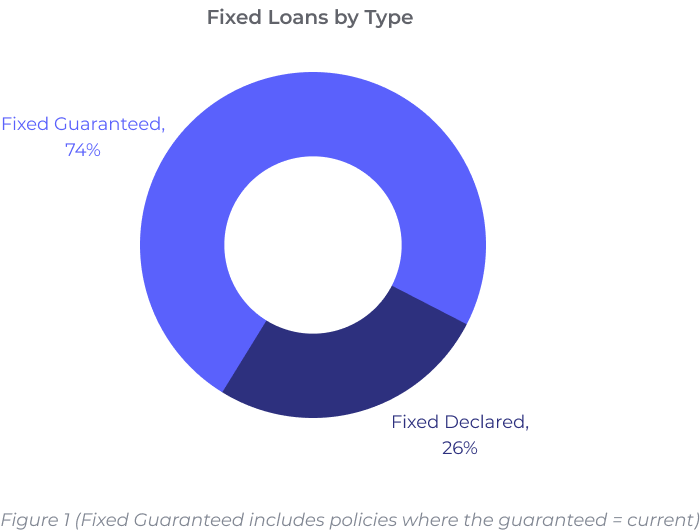

Of the 2 types of Fixed loans, Fixed Guaranteed is the most common.

Fixed Guaranteed is a loan that has a known rate schedule at the policy issue date and does not have the ability to change during the life of the policy, once that policy is inforce. We make this distinction because companies can choose a different guaranteed rate that applies to new issues going forward, however, they cannot change the guaranteed rate of those policies already inforce.

In essence, Fixed Guaranteed rates do what they say, the rate is guaranteed for each policy holder, however, two policy holders with the same product, may have different guaranteed rates depending on when their policies were issued.

Another key point is that the rate may have a scheduled change. For example, Principal’s Indexed Universal Life Accumulation II has a different rate for years 1- 10 and for years 11+. The rates for both time frames are guaranteed and known from issue.

For LifeTrends purposes, Fixed Guaranteed is when the Guaranteed Rate is equal to the Current Rate.

Fixed Declared

Fixed Declared on the other hand has rates that have the ability to change over time, at the discretion of the company. Fixed Declared loans sometimes take a little heat – yes, they can change, so does this make them actually Variable? It is the opinion of LifeTrends that this is not considered Variable for two reasons:

- It’s not tied to an external index.

- Companies call them Fixed Loans.

An example would be Symetra’s Accumulator VUL 1.0. It currently has a credit rate of 2% and a charge of 2.25% for the first 10 years. However, this loan has the ability to credit as low as 1% and charge as high as 4%, all on a guaranteed basis. This provides Symetra with a little wiggle room to make adjustments over time.

This example is a great segway into a major factor as to why loans may be more advantageous than withdrawals for most policyholders… Arbitrage. It may also be called the Charge Spread or the Credit Spread; depending on who wins in the scenario.

Arbitrage is defined as “The simultaneous or near simultaneous purchase and sale of the same or closely linked securities or commodities in different markets to make a profit on the (often small) differences in price.”

Obviously, this is not a definition designed for life insurance, but if we break it down and make a slight tweak, it works. The simultaneous purchase in different markets is a loan being taken. When the loan occurs, simultaneously there is an equal increase in the “different markets” of Loan Collateral Account (Credit) and Outstanding Loan Balance (Charge). The Credit Rate and the Charge Rate, as in the Symetra example,

are different (in price). Symetra nets 0.25% in this situation and are the beneficiaries of the Arbitrage. However, this isn’t necessarily a bad thing for consumers. Wouldn’t someone rather pay .25% on their loan debt than 2.25%?

However, the .25% Arbitrage spread is only for the first 10 years – starting in year 11, the credit rate increases to match the 2.25% charge. When both the charge rate and the crediting rate are the same, we have a “Wash Loan” because, in the end, it’s a wash, meaning the net gain is 0.

Figure 2 below shows the difference between a loan taken in Year 5 and a loan taken in Year 11, using the Symetra product. The Year 11 Loan does not consider that a previous loan was taken, which is why the outstanding loan balance is the same.

It’s important to understand the idea of Arbitrage and Credit/Charge Spread, as it will be a common theme, and serve greater importance, in upcoming Deeper Dive articles.

Variable Fixed

Now that we’ve discussed the two types of Fixed Loans, let’s explore Variable Fixed loans.

Variable Fixed Loans are the least common loan type benchmarked on LifeTrends. In this instance, Variable refers to the fact that the Charge Rate is tied to an external

index, such as the Moody’s AAA Bond Yield, and the crediting is Fixed. Some may be quick to think that a Variable Fixed Loan is a terrible idea because you could have a significant negative return if the variable charge rate greatly exceeds the Fixed Rate. However, this fear is calmed in that the terms Fixed in this case usually refers to a defined spread from the Variable Rate.

For example, National Life utilizes this type of loan on their FlexLife product. The charge is determined by the Moody’s AAA Bond Yield and the crediting is a fixed spread that allows for a small effective charge for the first several years, and then a spread of 0, to create a wash loan as seen above. Even if the Moody’s went to 19%, the crediting would be 18.5% and the effective charge would be .50%

National Life and Augustar are the only two companies LifeTrends benchmarks that utilize this style of loan. John Hancock also utilizes a spread methodology, but it is not tied to an external rate and therefore, would not be classified as Variable Fixed.

In Summary

Fixed Loans generally offer two types – Fixed Guaranteed and Fixed Declared.

- Fixed Guaranteed means that once a policy is in force, the rate and rate schedule cannot change.

- Fixed Declared means that the insurance company may change the rate, but the range is guaranteed by the contract, not to exceed a threshold.

With Variable Fixed loans, the Charge Rate may change, usually based on an external index, but generally the spread between the two (i.e. Arbitrage) is guaranteed.

And Arbitrage is the difference between what is charged and what is credited.

All these components will further come into play as we continue our Deeper Dive into Loans.