Deep Dive: Navigating the World of Policy Loans

By Paul Harrington, Senior Market Analyst

Introduction

Life Insurance, as understood by the general public, is pretty simple. You pay a premium on a regular basis, and when you die, your beneficiaries get a lump sum payout.

Easy, simple, boring… life insurance.

What’s often greatly misunderstood is the Cash Value component!

Permanent products generally offer the ability to access cash values. And the most common types are Whole Life and any of the Universal Life chassis-based products, such as Indexed and Variable. With these products, the owner can access Cash Value either through a withdrawal or a loan.

This Points article and subsequent related posts will be entirely focused around that last, underlined word: Loans. As loans go by many names and work in several different ways, LifeTrends will attempt to define and categorize the loan types that exist in the market today.

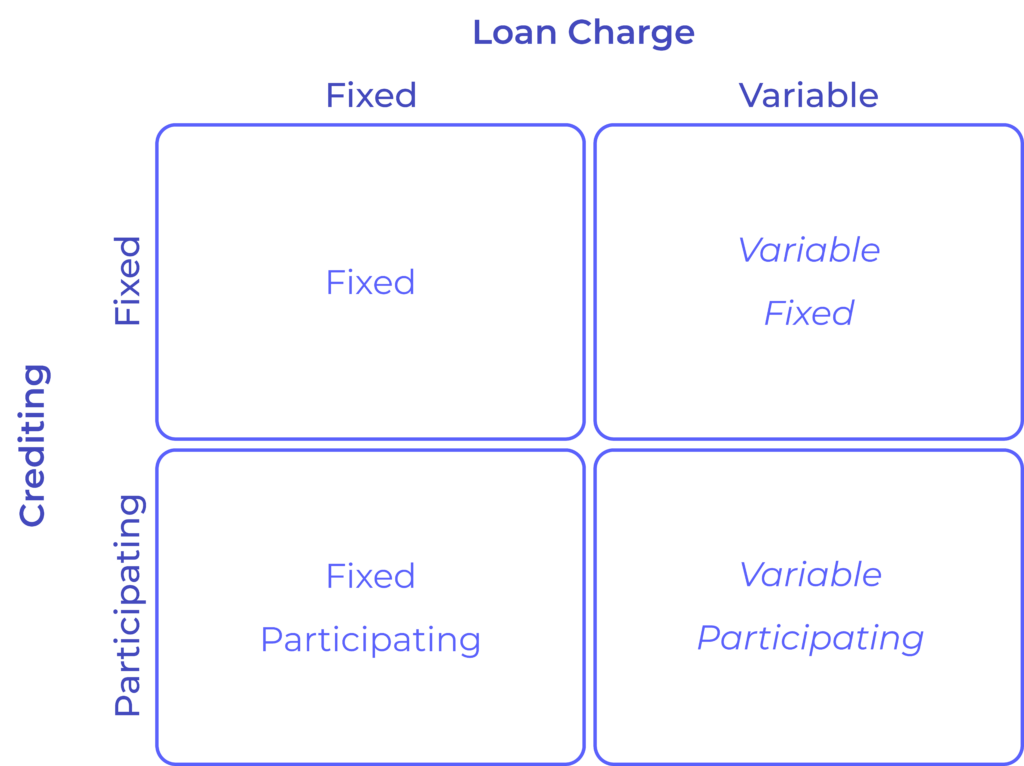

The rest of this Points article will address why loans are an important element of life insurance and explain the two components: Charging and Crediting. We will then introduce “The Loan Quadrants” as it’s affectionately called, to subdivide UL loans into 4 distinct groups based on the two components.

Distributions

While the primary purpose of Life Insurance is to provide a death benefit, there are many other benefits an owner can enjoy during their lifetime. And for many, the appeal of Cash Value accumulation is a goal. Cash Value growth can be determined by a number of factors, including indexed strategies, declared rates, variable sub-accounts, and more. Conversely, Cash Value can be dispersed in two ways: withdrawals and/or loans.

Withdrawals are straightforward and work just like a withdrawal of funds does from a bank. An account owner withdrawals money from their account, and, as a result, the account balance reduces by the exact amount of the withdrawal.

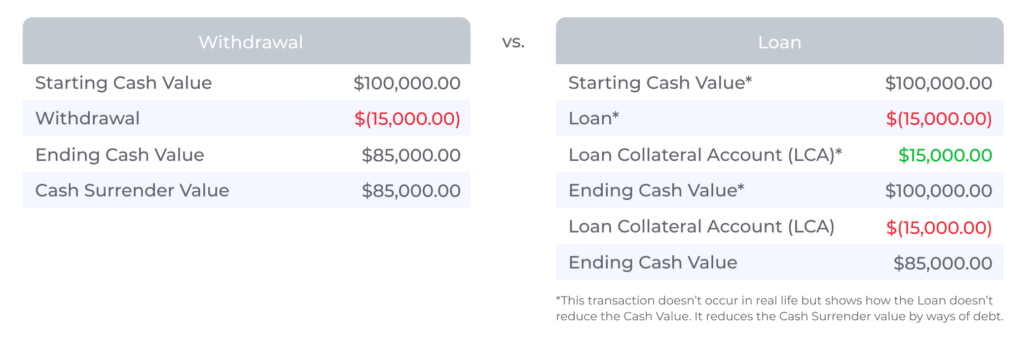

A loan on the other hand, distributes money out and holds an equal portion of the Cash Value as collateral that must be “paid back” in order to satisfy the debt. Unlike withdrawals, the Cash Value Account is not reduced, which allows the funds within the life insurance policy to continue growing. A simplified example below helps illustrate the concept.

In this case, the loan is appealing because after it is taken, the Cash Value eligible to grow, is greater. A 5% return on $100,000 is greater than a 5% return on $85,000.

But this example is only considering a single moment in time. The Loan will have interest charged against the loan balance as time goes on, which increases the Loan Debt, which in turn further decreases the Cash Surrender Value, assuming no Loan Repayments are made.

The way interest is charged on loans is one of the two components and represents one axis of the “The Loan Quadrants” that will be introduced later in this article.

The other component and axis of “The Loan Quadrants” concerns crediting on the Loan Collateral.

Loan Collateral is the amount of Cash Value held against the Cash Surrender Value. For example, it’s the car, in a car loan. You take a loan to pay for the car, and the car itself is held as collateral, but can still be used.

In the name of simplicity, we are going to assume that Loan Collateral is its own account, and that it is equal to the total amount of loan taken. For example, if a $50,000 Loan is taken within a life insurance policy, the Loan Collateral Account (LCA) will be $50,000. Loan accounts can be credited, which in turn increases the LCA, and therefore increase the Cash Value. As we pointed out earlier, the higher the Cash Value, the more ability to grow.

The Quadrants

Earlier in this article, we mentioned the two axes of the below Loan Quadrants – Loan Charge and Crediting. We also further outlined the various elements of each. Below is a chart that helps explain the Loan Quadrants. We will break down each of these quadrants into greater detail in subsequent Points articles.

The Loan Quadrants contains the different variations of Charges and Credits as defined below

- Loan Charge

- Fixed

- A rate set by the company that typically2 changes infrequently and is the alternative to indexing

- Sub-Categories

- Fixed Guaranteed

- Rate set at issue and guaranteed for the life of policy

- Rate set by company but is not guaranteed

- Fixed Guaranteed

- Sub-Categories

- A rate set by the company that typically2 changes infrequently and is the alternative to indexing

- Variable

- A rate tied to an external index/factor that changes

- The Moody’s AAA Corporate Bond Yield Average is the standard external index used, but it is not the only one.

- A rate tied to an external index/factor that changes

- Fixed

Loan Crediting

- Fixed

- A rate set by the company that typically changes infrequently and is the alternative to indexing

- Sub-Categories

- Fixed Guaranteed

- Rate set at issue and guaranteed for the life of policy

- Fixed Declared

- Rate set by company but is not guaranteed

- Fixed Spread

- Spread rate between crediting and charge rate set by company

- Fixed Guaranteed

- Sub-Categories

- Participating

- Crediting Rate is determined by an external index

- Sub-Categories

- Matching Participation

- Return reflects the crediting of indexed allocations within policy

- Independent Participation

- Return is tied directly to an indexed strategy,

- Some indexed strategies only offered for Loan Collateral.

- Return is tied directly to an indexed strategy,

- Matching Participation

- Sub-Categories

- Crediting Rate is determined by an external index

- A rate set by the company that typically changes infrequently and is the alternative to indexing

These definitions allow us to determine the 4 loan types that exist on ULs as defined by LifeTrends, and will be used to help provide additional clarity both within our platform and in future POINTs articles.

- Fixed

- Fixed Participating

- Variable Fixed

- Variable Participating

This concludes the first article in our Loans series. The next article will help explain how Fixed and Variable Fixed loans work, what companies utilize these loan strategies, and the nuances between them.