Is There a Slowdown in Term Repricing? LifeTrends Digs into the Rumor Mill

By Sydney Presley, Director of Product Management

Term – a simple life insurance product where the pricing game can be determined by mere pennies. In such a close market, frequent reprices are often a necessity to stay on top. But we’ve heard some buzz that maybe there’s been a large slowdown in term reprices in 2024. We’ve been tracking term prices for nearly 10 years… so we decided to dig in to see: are those sentiments reflected in our data?

But we went beyond that, between life table updates, reserving changes, the pandemic, and the sheer number of updates, we looked into how the competition and pricing has changed since we launched the Term Benchmark in 2014.

Frequency of New Products/Reprices

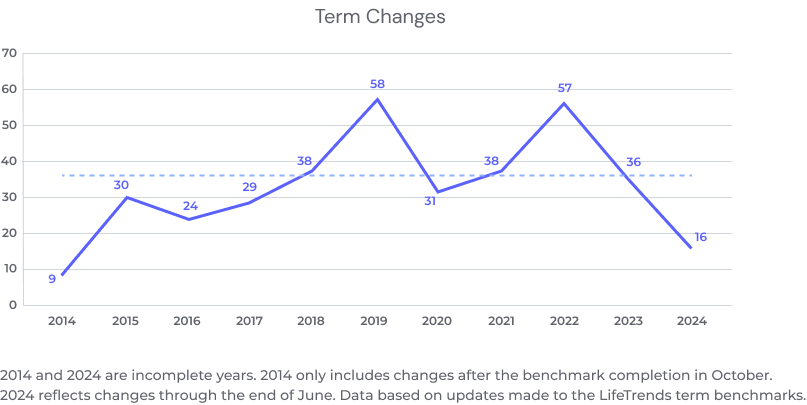

About that pricing slowdown… From 2015-2023 (using complete years of data) the LifeTrends term benchmarks has seen a median 36 reprices per year. This year we’ve seen 16 through the end of June. While close, it’s just shy of being on pace with the median number of changes over the longer timeline. That being said, we can understand why it might feel different – it’s starkly off pace from the spike in reprices seen in 2022. Graph 1 below shows there are 2 notable years where spikes in the number of term changes are seen.

Graph 1.

The spike in 2019 can at least partially be attributed to carriers updating their term products to be compliant with the 2017 CSO and PBR changes that were required to be effective by January 1, 2020.

Looking at 2022, there weren’t any regulation changes to explain the spike; however, when looking a little closer to the carrier level, the increase can be attributed primarily to 3 carriers: Legal and General, Lincoln Financial, and Protective.

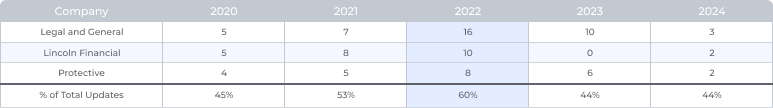

Table 1 shows the number of reprices made by those carriers in the years surrounding 2022. In that year, they accounted for 60% of all tracked updates. Notably, Legal and General had 16 in 2022 alone and are far off that pace this year.

Table 1.

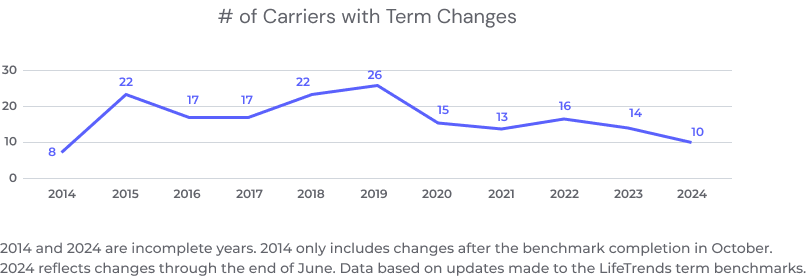

Since we found that a few carriers could skew the number of pricing changes pretty drastically, we reviewed individual carriers who have repriced 1 or more of their term products in a year to see if that remained relatively constant. Graph 2 shows a similar spike to Graph 1 in 2019; however, the number of carriers with reprices has remained relatively constant between 2020 and 2023 (and is on track to be in line in 2024).

Graph 2.

So has there been a slowdown?

When looking at it as a trend over the past 2 years, certainly. Though the main trend can be explained by reprice frequency from a handful of carriers. If we exclude their changes, and consider the number of carriers who have made changes, 2024 is generally on track with previous years.

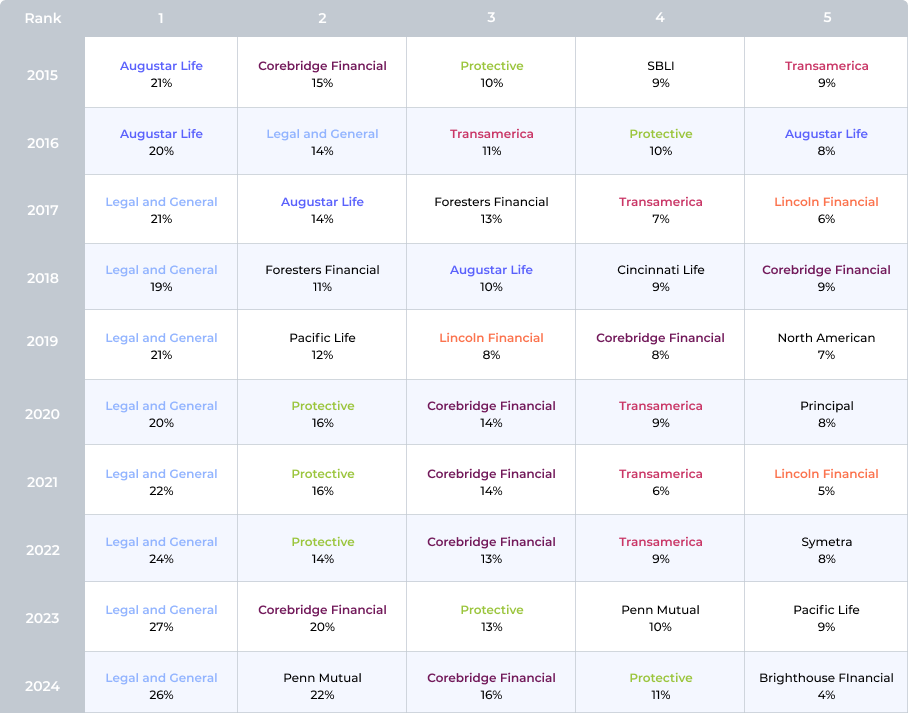

Now… with all of those reprices, does that translate to a carrier remaining at the top of the market?

Table 2 shows the top 5 products in a given year by the percentage of cells ranked in the top 3. The table is color coded to help identify a carrier’s movement year over year. As many in the Term arena might have guessed, Legal and General has held the top spot in the market for the past 7 years, while a handful of other carriers seem to play the pricing game to jockey for the remaining top spots.

Table 2. Percentage of cells ranked in the top 3 using a $1M death benefit across all term durations

Table reflects benchmarked values on July 1st of each year. Carriers who show up 3 or more times in the table have a unique color.

Pricing Over Time

Last but not least, with benchmarking data since October of 2014, over 360 pricing changes, and knowing some reprices change select cells by mere pennies – how have the most competitive Term premiums shifted?

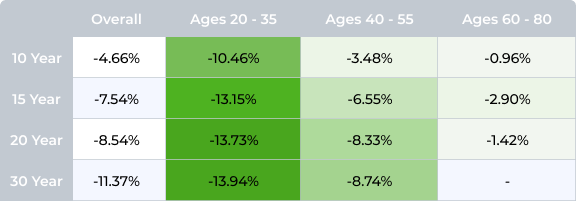

Generally, premiums are cheaper comparing July 2015 to July 2024, but how much cheaper depends entirely on the Term duration and age. Table 3 shows the average percentage premiums are cheaper by age groups and Term duration. The largest movement in this time is for insureds ages 20-35, with longer Term durations seeing larger decreases in premium.

Table 3. Average change in Term premiums for $1M from July ’15 to July ‘24

Ages 60-80 saw the smallest average change; however, it is important to note that changes for this age group were quite volatile. Some cells saw premiums decrease by 24%, while others increased by as much as 42%.

Conclusion

So is the rumor true? It might depend on your perspective. In the lens of the last 2 years, a few carriers have slowed reprices quite a bit which does suggest a slowdown. However, based on what we are seeing over the longer time period, this year feels generally on track.

While term is primarily a price game, there are many factors that ultimately may draw buyers away from the “cheapest” priced product. The quality and financial stability of the carrier, ease of underwriting process, the flexibility of conversion options, and ability to convert, can all be drivers when considering what Term product to buy.

Keep your eyes peeled for a new Points coming soon on the various term conversion options offered on term products today!