Term Conversions

By Paul Harrington, Senior Market Analyst

Introduction

On September 16th, 2024, LifeTrends launched its enhancement to Features with the expansion of a new Term Conversion section. As such, we wanted to celebrate by taking a look at the state of conversion privileges today and how that analysis, along with discussions with our valued partners, helped us arrive at the Term Conversion section design.

What Is It?

Term Conversions are a valuable, and nearly necessary, product feature of Term Life Insurance that allows for the insured to convert their existing Term policy into a new life insurance policy. The most common conversion landing spot is a permanent product, however some conversion provisions allow conversion into another, longer duration, Term Insurance. The appeal for consumers with Term Conversion privileges is two-fold;

- No Medical Proof of Insurability at time of Conversion

- When an insured looks to convert their policy, they do not have to go through medical Underwriting, assuming the face amount is not increased.

- Allows for someone to lock in a potentially healthier rating for an extended period of time

- In theory, someone could get their policy issued Preferred Best, develop a chronic illness, and then convert to a permanent policy and stay at a Preferred Best rate class. While this is best outcome for client, its generally not favorable to the carrier.

- Flexibility

- If the insured is not 100% committed to a particular type of permanent life insurance, or maybe has concerns regarding affordability, but still understands the value of having life insurance, they can purchase a Term policy with a Conversion Option and take time making a decision that’s best for them with the added benefit of #1.

Why Do Carriers Offer This Feature?

Every single company benchmarked on LifeTrends offers some form of Term Conversion. Conversions are not regulatory therefore their existence on so many policies demonstrate a direct preference from the market. That said, it’s imperative that carriers include a Term Conversion for the reasons stated above. Clients really like the flexibility and the lack of future UW. Agents like that Clients like it as it opens an opportunity to make a higher premium sale in a few years when they move to a permanent plan. Carriers like it because everyone else likes it and Conversion Rates are historically low. Several studies2,3 from the Society of Actuaries put Conversion Rates at less than 8% on average of eligible policies converting.

How Does It Work?

The basic elements of a Term Conversion option come down to two questions: how long does the Conversion Option last and what products can I convert to?

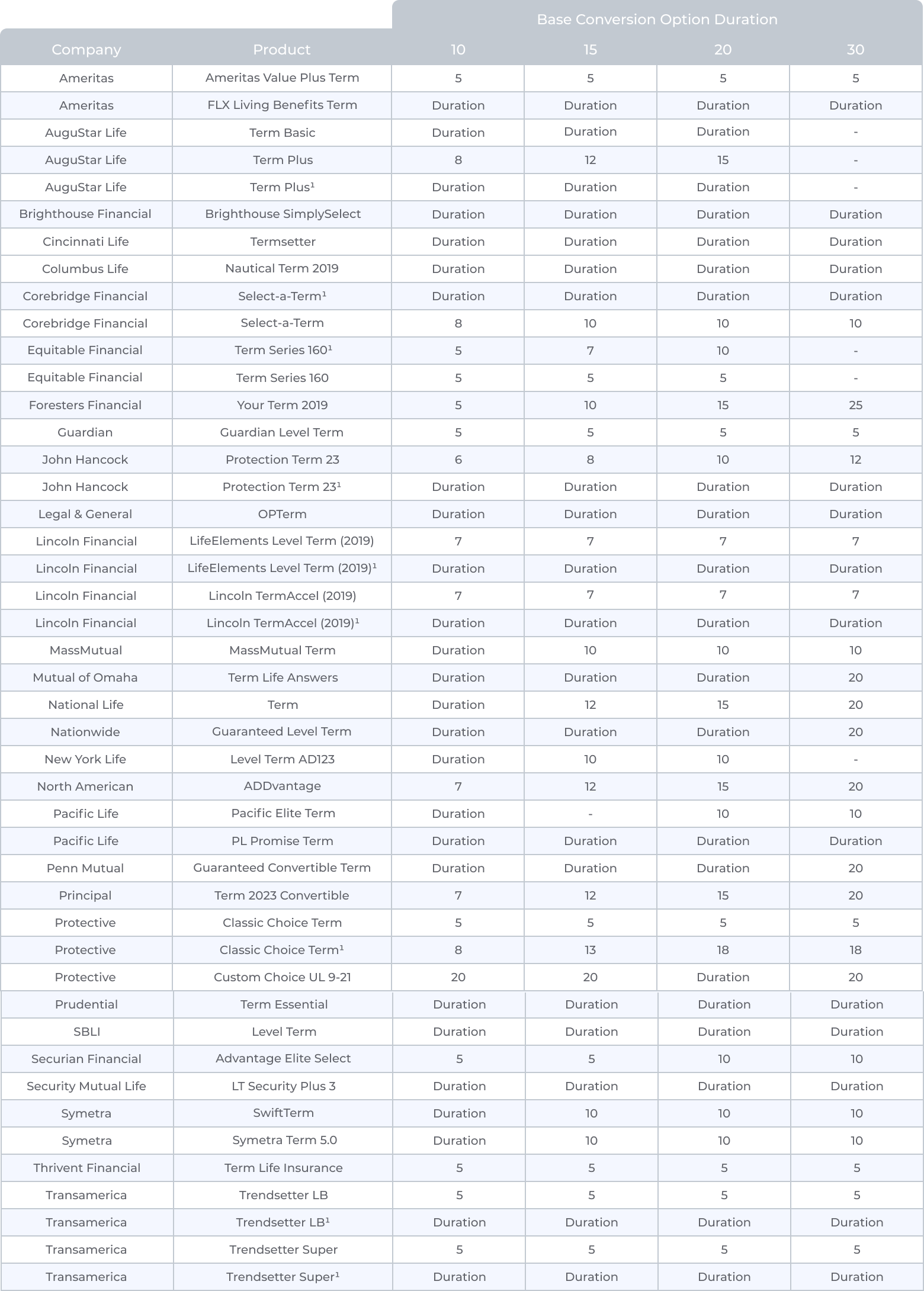

To understand how long the Conversion Option is available, the first place to start is the Base Duration. LifeTrends defines the Base Duration as the duration that comes standard on the plan, before any sort of additional rider or enhancement. These durations can be as short as 5 years and last as long as the full duration of the Term policy. Table 1 displays the Base Duration period for Term products benchmarked on LifeTrends. Several companies and products appear twice – this is because of the life insurance products offered in which the insured can convert to, which we will tackle next. These Conversion Options allow conversion into different products based on duration options.

Table 1.

1 Indicates that the product has two durations for conversion, each with a different set of product(s) available for conversion.

The 2nd question is: What products can the Term policy be converted to? This is not always a straightforward answer.

There are several factors that determine what products the insured is able to convert into. One factor was briefly mentioned above is a split on the products available based on the duration. More often than not, a shorter duration Conversion Period offers access to more products, typically those also being currently sold as new issue policies. An example of this would be John Hancock’s Protection Term. In the first 6 – 12 years, depending on the Term duration, they allow you to convert to any single life product available for sale. After that period it becomes a limited offering.

Current Practice vs. Contract Provisions

A factor to consider is what we call Current Practice vs. Contract Provisions. Contract language is ultimately what determines what a carrier might be able to offer for Conversion. However, the language used is not consistent across the industry – it is written differently by each carrier and in the right circumstances, could be significant for policy holders. However, the feature is promoted much the same by all carriers.

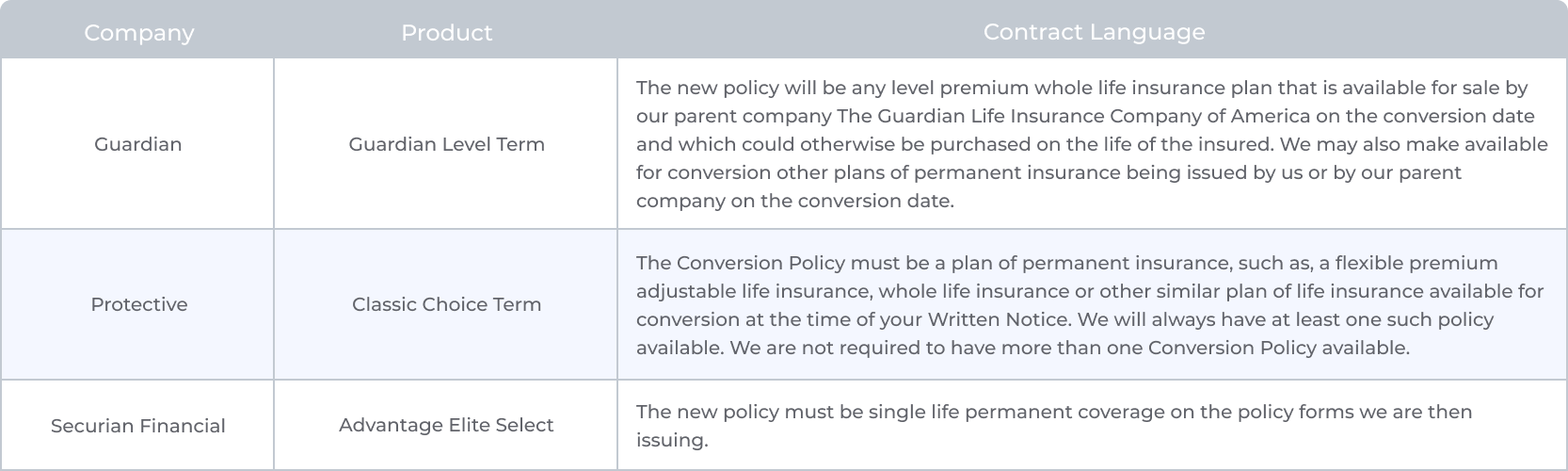

Let’s compare Protective Classic Choice Term, Guardian Level Term, and Securian Advantage Elite Select.

Table 2.

For the purposes of tracking on the LifeTrends platform, Guardian and Protective would be considered Limited for product availability, while Securian would be considered Any. That said, there are key differences between what Protective and Guardian offer that should be recognized. Protective’s Current Practice allows for Conversion into all their currently available permanent plans, but as the language points out, they control what is available at conversion and are only required to have 1 product available. So, while it’s Any for a client today, there is no guarantee that a client in 5 years will have the same options available. In contrast, with Securian, who offers Conversion to a single life policy they are then issuing. This means that a client today, and a client in 5 years, will have the same opportunity. While it’s totally possible Securian slims down their product portfolio in 5 years, regardless, both of these clients have the same chance to convert to any plan that is available to all new issues. The hybrid of these two would be Guardian. For their Whole Life suite, Guardian is Any in the same way as Securian. This is arguably their flagship product line but leaves out their VUL and UL offerings. Guardian does have the right to make those plans available for conversion, if they want too though. It’s easy to see how these could be quickly spreadsheeted into similar categories but when boiled down, have distinct differences.

It is for these reasons that we state both the Products Available for Conversion, which represents the Current Practice, and state the Contract Language in Features.

Extended Term Conversion Options

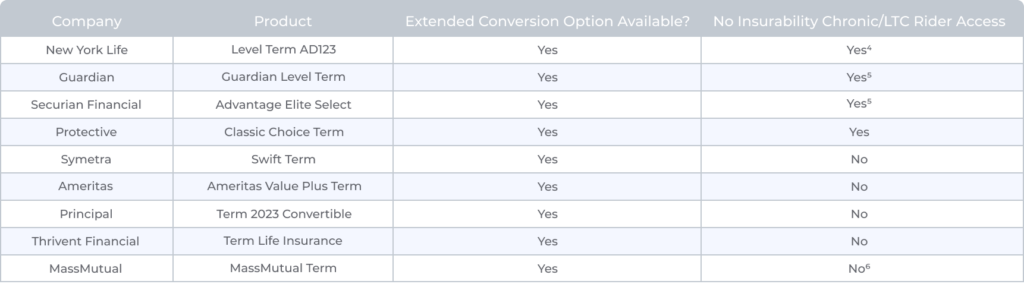

Some products offer an Extended Term Conversion option which is normally available via a Rider. As the name implies, it Extends the Term Conversion period from the base duration. In some cases, product availability expands as well. For example, the recent launch of the Conversion Enhancement Rider on Symetra’s SwiftTerm not only extends the duration of conversion availability, it expands the potential conversion products.

An area of competitiveness that is becoming more popular with Extended Term Conversion riders is the ability to convert into a policy that has a paid-for Chronic Illness Benefit without proof of insurability. Plenty of carriers allow you to convert into a policy that has these riders, but if you want the Chronic Illness / LTC rider, you must go through medical underwriting again. Going through medical underwriting defeats one of the two key main benefits described at the beginning of this post. This enhanced extension is achieved in different ways. Securian and Guardian both have a unique rider explicitly for the Chronic/LTC benefit, in addition to the traditional Term Conversion rider. Protective combines these benefits into 1 rider. These riders do come at a cost and vary across carriers based off of design and structure as just discussed. For example, on a 20 year Term Policy, a 40 year old Preferred Male, would pay 6.39% more Symetra’s rider and 13.45% more for Protective.

Table 3.

4 on Whole Life products only

5 Separate Rider from Duration Extension

6 Can convert to LTCaccess but with requirements

Additional Considerations

Something LifeTrends does not track is whether a Conversion Credit exists on the policy. Often, a Conversion Credit will apply your Term premium towards the 1st year of premiums in the new policy. At least, that is the general idea. However, the variations in how Carriers handle this, some being contractual, some being a “current business offering”, and what information they include in the product material, results in inconsistencies with the data and challenges in maintaining accuracy.

Conclusion

After the death benefit, the Term Conversion privilege might be the most important feature on a Term policy. Unsurprisingly, this means the majority of products offer some form of Term Conversions, and for the ones that don’t, they just tend to be cheaper. Term is known to essentially be a commoditized product. There is a Term Length with a corresponding level premium. This means that pricing competitiveness is the main battleground for competition, as Sydney Presley pointed out in the previous post on Term Reprices. Conversions give companies that don’t want to play that game another way to provide meaningful benefits a client may be willing to pay for. Term Conversions are also an amazing tool for the agent. Client can’t afford an expensive permanent policy at the moment? No problem! Term Conversion to the rescue. Client worried about future health deterioration, no problem! Term Conversion to the rescue. Lock in a client’s insurability? No problem! Again, Term Conversion is on the job.

2 https://www.soa.org/resources/research-reports/2017/predictive-models-conversion-studies/

3 https://www.soa.org/resources/research-reports/2016/2016-report-conversion-experience-term-plans/